Cardano has been seeing an impressive amount of interest from large holders as it defied the market-wide turbulence with a price hike.

As expected, Cardano (ADA) went on a rally to an 18-month high of $0.80 early Wednesday. ADA’s bullish momentum surfaced while the broader crypto market witnessed a decline — the global cryptocurrency market cap fell 1.2% in the past 24 hours to $3.22 trillion, according to CoinGecko data.

Cardano is up 4.1% over the past day and is trading at $0.79 at the time of writing. Its daily trading volume increased by 24%, reaching $2.27 billion.

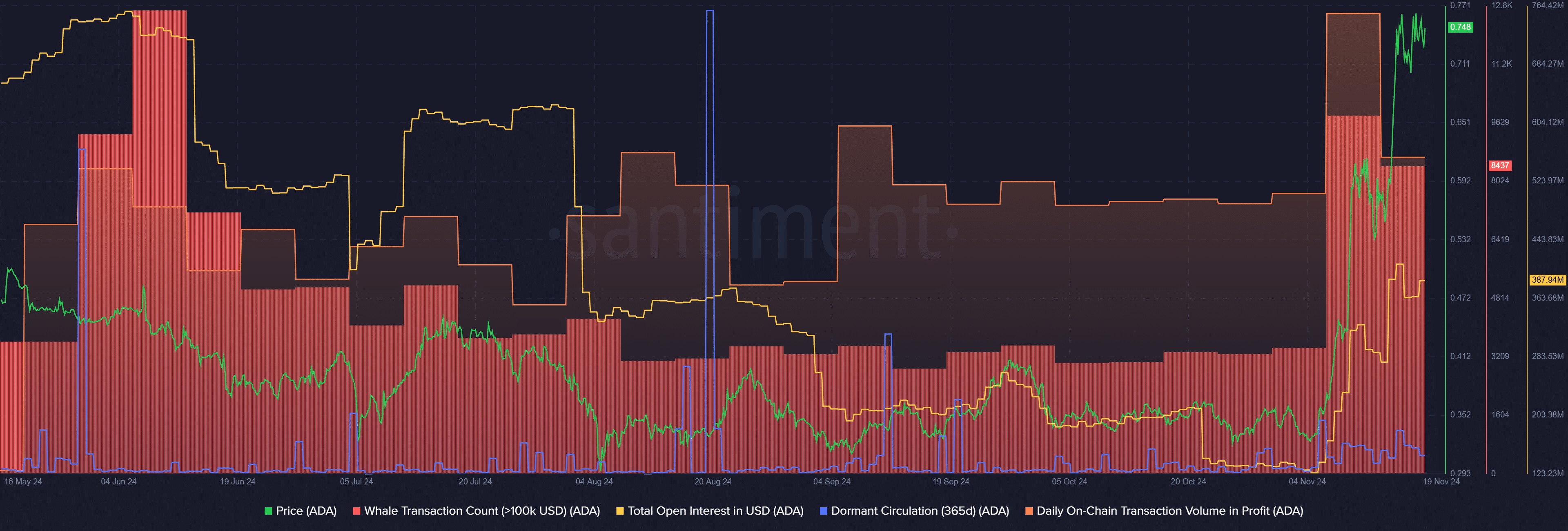

The surge came thanks to an impressive rise in Cardano’s whale activity. Large transactions consisting of at least $100,000 worth of ADA reached 9,824 last week, marking a five-month high, according to data provided by Santiment.

Moreover, the Cardano total open interest also broke the $400 million barrier for the first time since early August, per Santiment data. The indicator shows increased interest from derivatives traders.

Despite the price surge, long-term Cardano holders with positive returns have declined. Data from the market intelligence platform shows that the asset’s one-year dormant circulation dropped from 69.3 million ADA on Nov. 16 to 30.5 million ADA on Tuesday.

Similarly, the weekly on-chain transaction volume in profit also plunged from 36.4 billion ADA to 29.6 billion ADA over the last two weeks.

This shift in the investors’ movements suggests that the profit-taking trend has cooled down at this point as ADA holders might be eying a further upside.

However, it’s important to note that the increasing trading volume, whale transactions and open interest could put Cardano in the highly volatile zone. The rise of the Ukraine-Russia conflict could also add to the market volatility.

Disclaimer

The information provided in this article is only for educational and informational purposes and should not be considered financial or investment advice. We are not licensed financial advisors. Always conduct your research and seek guidance from a certified financial professional before making any investment decisions.